Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Solar inflation reverses as renewable costs in Asia reach all-time low

Plummeting Utility PV solar costs beat coal power to emerge as the cheapest power source in the region

4 minute read

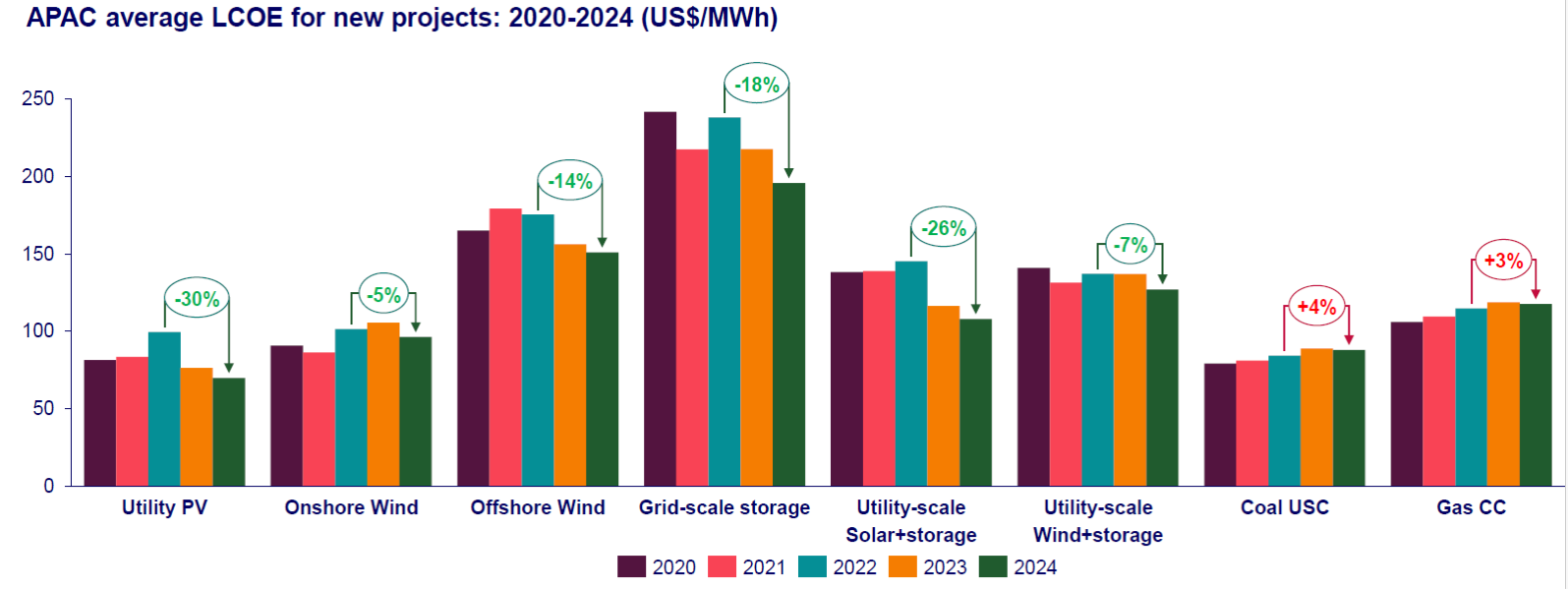

The cost of electricity generated from renewable sources, known as the levelised cost of electricity (LCOE), is declining significantly in the Asia Pacific (APAC) region and reached an all-time low in 2023, according to Wood Mackenzie’s latest analysis of LCOE for the Asia Pacific region.

This decline makes renewable energy increasingly competitive with conventional low-cost coal power, driven by a significant reduction in capital costs for renewable power. Renewable energy costs in 2023 were 13% cheaper than conventional coal and are expected to be 32% cheaper by 2030.

Alex Whitworth, Vice President, Head of Asia Pacific Power Research at Wood Mackenzie stated: “Utility PV solar has emerged in 2023 as the cheapest power source in the region, while onshore wind is expected to become cheaper than coal after 2025. Renewables firmed with battery storage is becoming competitive with gas power today but will struggle to compete with coal before 2030.”

Source: Wood Mackenzie Asia Pacific Power & Renewable Services

Source: Wood Mackenzie Asia Pacific Power & Renewable Services

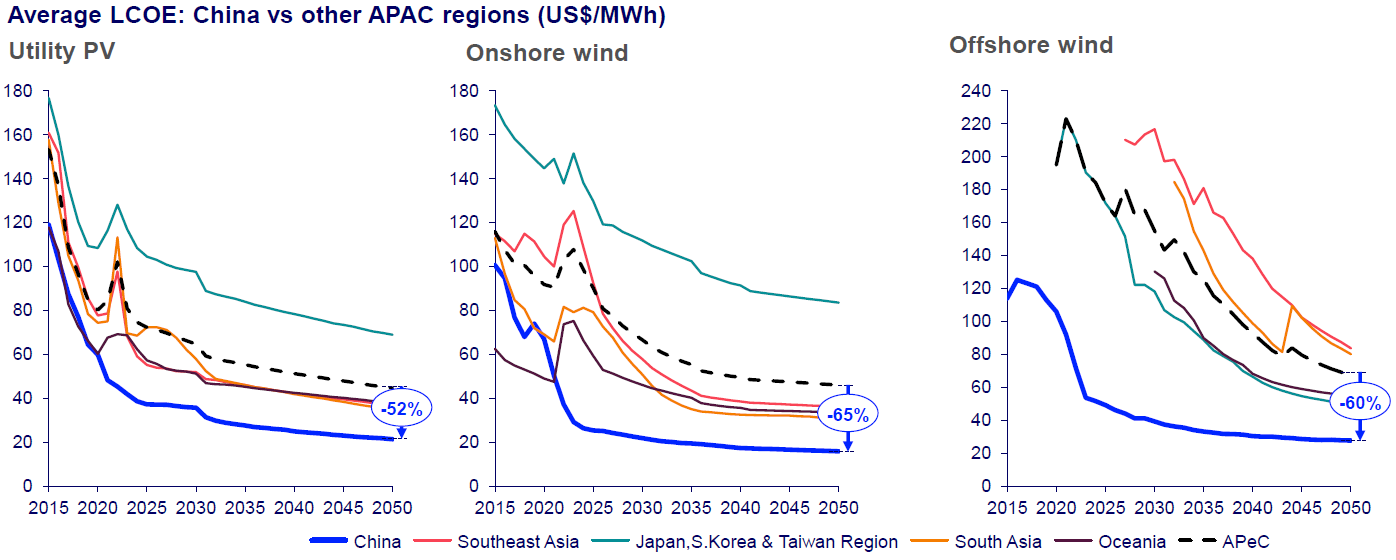

China is leading the way in lowering the cost of renewables, with utility PV, onshore wind, and offshore wind being 40-70% cheaper compared to other Asia Pacific markets. China will maintain a 50% cost advantage for renewables out to 2050, allowing the country to maintain its lead in renewables deployments.

Solar power is the winner on low-cost over the last year

“Solar photovoltaic (PV) power costs saw a significant decline of 23% in 2023, marking the end of two years of supply chain disruptions and inflation. Utility PV emerged as the cheapest power source in 11 out of 15 countries in the Asia Pacific,” said Sooraj Narayan, Senior Research Analyst, APAC Power & Renewables at Wood Mackenzie.

The new-build solar project costs will drop another 20% by 2030, driven by falling module prices and increasing oversupply from China. The decline in solar technology costs in 2023-24 has put pressure on coal and gas, with LCOE for utility PV dropping by an average of 23% across Asia Pacific in 2023, driven by a 29% decline in capital costs.

Distributed solar has experienced an even greater decline in costs –a 26% decrease in 2023, and the technology is now 12% cheaper on average than residential power prices creating large potential for more rooftop solar applications.

“This trend has made distributed solar increasingly attractive for end-users in many markets in Asia Pacific, with costs already 30% below rising residential tariffs in China and Australia. However, some markets like India with subsidised residential power tariffs will need to wait until 2030 or later to achieve competitive distributed solar prices,” Narayan added.

Wind power costs have seen more modest cost declines

While onshore wind costs were higher than solar by 38% in 2023, Wood Mackenzie forecasts a 30% drop by 2030 as cheaper Chinese turbines gain market share. Markets such as Australia and Southeast Asia will benefit from the low-cost import of wind power equipment from China, while Japan and South Korea with more limited Chinese turbine uptake and focus on local supply chain will observe onshore wind costs staying above US$80/MWh by 2030.

The report also highlights the increasing competitiveness of offshore wind with fossil fuel power in Asia Pacific, with costs falling by 11% in 2023. Offshore wind costs are now on par with coal power in coastal China and are expected to become cheaper than gas power in Japan and the Taiwan region by 2027 and 2028, respectively. Falling capital costs and technology improvements are opening up new markets for offshore wind in India, Southeast Asia, and Australia over the next 5-10 years.

Source: Wood Mackenzie Asia Pacific Power & Renewable Services

Fossil fuel power costs have been rising

Coal and gas generation costs have increased by 12% since 2020 and are projected to continue rising through to 2050, primarily due to carbon pricing mechanisms. Developed markets in Asia Pacific are expected to experience a significant increase in carbon prices, reaching US$20-55/tonne by 2030, while the carbon prices in Southeast Asia and India are expected to remain low. Gas power costs remain above US$100/MWh on average out to 2050, meaning they gradually lose the battle on costs with offshore wind over the next decade.

Green hydrogen and ammonia priced out of the market

The region faces challenges in the deployment of green hydrogen and ammonia, stated the report. The cost expectations for these technologies have nearly doubled since last year, making them significantly more expensive than conventional coal and gas power even out to 2050.

“Even by 2030, the cost of firing a gas turbine using 100% green hydrogen is projected to be more than triple that of using only natural gas, primarily due to hydrogen fuel costs being five times higher than natural gas. Similarly, coal firing with 50% green ammonia is estimated to be four times costlier than just coal firing in 2030,” Narayan said.

“Solar power costs have reached an historic low in the Asia Pacific region in 2023, reversing fears of permanent cost inflation. But while low costs support a continued boom in renewables investments, there is concern among investors on profitability, grid integration, backup and energy storage. Government policies will play a crucial role going forward to support upgrading grid reliability, transmission capacity, and promoting battery storage to manage the intermittent nature of renewables,” Whitworth concluded.

EDITOR’S NOTES

LCOE is a standard power industry metric used to measure the total cost of power generation averaged per megawatt-hour over a project’s lifetime. LCOE indicates the revenue needed for each megawatt-hour to cover all costs and reasonable profits.

Asia Pacific in this report includes 15 markets: Mainland China, Taiwan Region, Japan, South Korea, Singapore, Thailand, Malaysia, Philippines, Vietnam, Indonesia, India, Pakistan, Bangladesh, Australia, New Zealand.